Nuggets of Wisdom: DMAW’s DAF Coffee Talk

Maria Fisher is a Membership Campaign Manager for The Nature Conservancy and may be reached at mfisher@tnc.org.

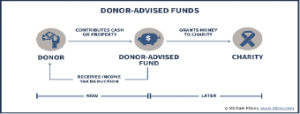

I attended the Coffee Talk: Donor-Advised Funds back in May and was energized by Karin Kirchoff’s thought-provoking presentation on Donor Advised Fund giving and inspired by the conversations in the room and the information shared. Donor-advised funds (DAFs) are a fast-growing charitable giving vehicle because they are an easy way to give to charities, the donor doesn’t need to manage their account, gets an immediate tax deduction, and the funds in a DAF grow tax free.

One of the biggest take-aways was how much DAF accounts are growing in number and dollars.

Did you know there are more than 1.2 million DAF accounts in the US as of 2021, with about $234 billion dollars sitting in these DAFs? That is a 39.5 percent increase from the revised 2020 total of $167.81 billion in DAFS.

Here are few of the other tidbits I learned during this session:

According to Fidelity, they alone distributed approximately $11 billion dollars in donor grants in 2022, a $1 billion dollar increase over 2021.

77% of these grants went to prior gifted organizations, while 23% were new grants and the average DAF grant is around $4,798, so ask for a DAF gift!

The challenge: Roughly 10% of DAF grants provide a name only with a check and only another 8% share name and address, so how do we know who our DAF donors are?

The opportunity: First, do some research. Do the DAF custodians sending the checks have portals that our organizations have access to? Many of the prominent ones like Fidelity do, so the next question is: who in your organization has this access and will they share the information with you? Then work with your cash receipting folks to set up a notification process so that you can research DAF gifts and correctly identify donors.

Next, we should use every channel available to ask our donors in coordination with our other fundraising strategies. Ask them to give a DAF AND to let us know if they have or are going to give us a DAF so that we may thank them appropriately. Tactics like a postcard mailing to your full file are worth exploring.

We should also use all channels available to acknowledge that donors gave through a DAF once we know they did and encourage them to give in this fashion again.

Last, but not least, make it easy for your donors to give a DAF gift. Consider the tools out there that will help like widgets you can easily embed on your online donation forms (Free Will, Give Better, Givechariot, DAF Direct).

Another thing I learned: partnerships matter. We should consider the relationships we make with colleagues in this field like brokers, financial advisors and within our industry. They can all be tremendous resources to learn from and collaborate with—much like the opportunity to participate in this session and connect with new colleagues and hear about their experiences.